Digital agriculture is a rapidly expanding segment of the agricultural industry. It utilizes advanced technologies to enhance food production, greenhouse management, and supply chain operations. McKinsey reports that approximately 55 percent of large farms currently employ farm management systems, and over 50 percent utilize some type of precision agriculture techniques.

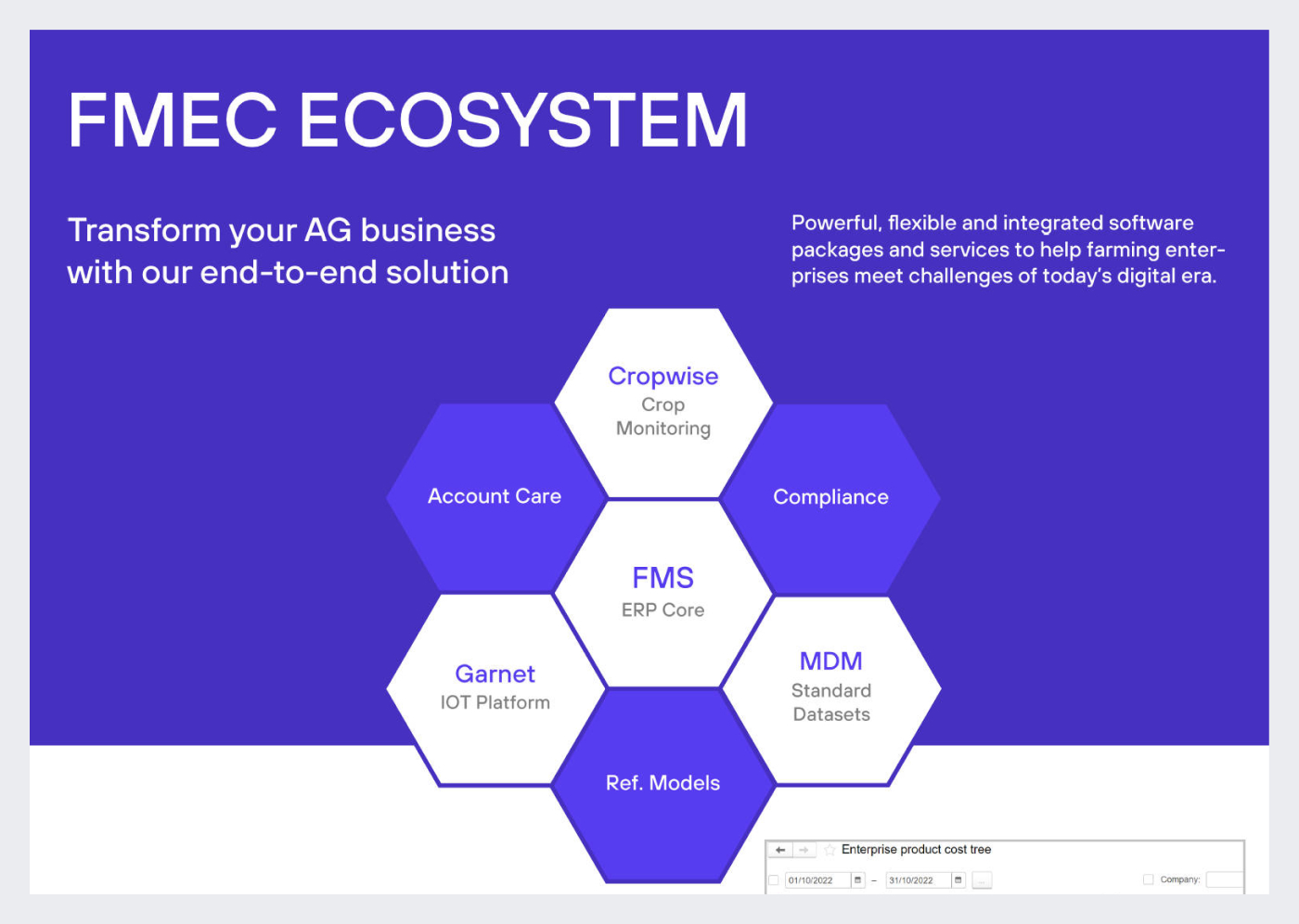

Andrey Skripchenko, CDO at FMEC Group is sharing his market overview and most significant insights with 1Ci Blog readers. FMEC GROUP provides a unique set of services and solutions for farm management, mechanization, and digital finance and trade.

The company's strategy is focused on facilitating long-term sustainability through the deployment of practical solutions at the farm level and providing expert support. By combining cutting-edge technology, big data, and algorithms, the team's solutions are aimed to change the way farming decisions are made in the field.

Overview of the Agricultural Sector

The agriculture sector is extensive and diverse, comprising numerous subdomains that vary significantly in technology and production processes. Large subdomains include, for instance, livestock, Dairy farms, Crop production. But even within crop production there are numerous second and third-level subdomains, such as arable farming and horticulture, flower cultivation, orchards, and greenhouse operations. Each specific area has its unique production process, which can differ significantly.

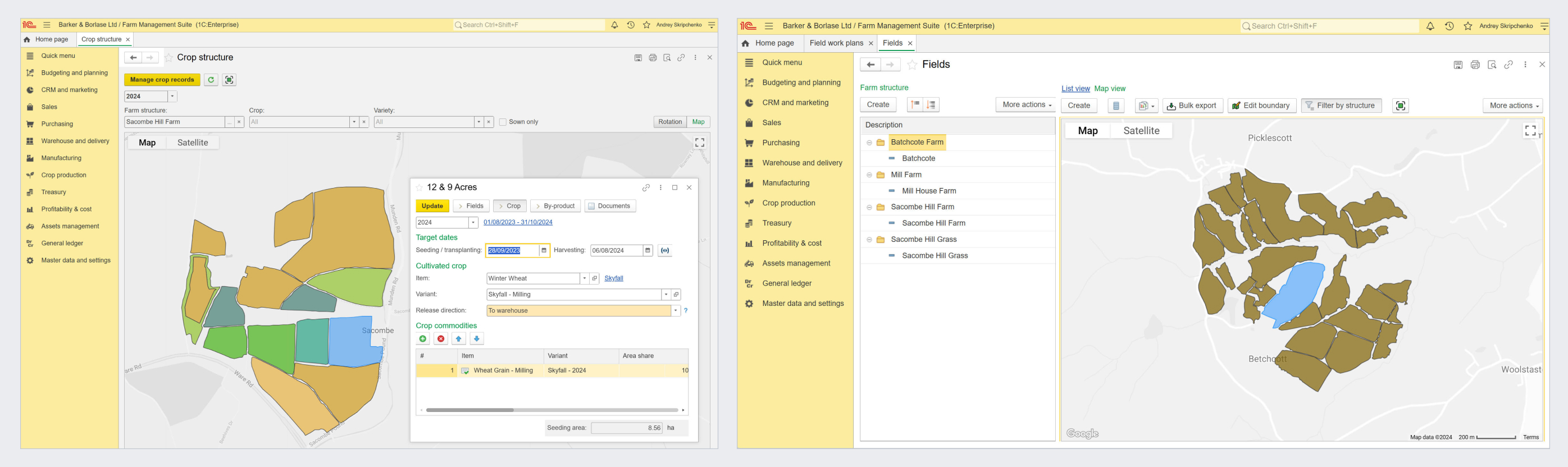

The processes also vary depending on the country and climate region. For instance, in Europe, arable farming is seasonal; crops are not harvested in winter, single crop can be harvested during the summer-autumn period. However, if you go slightly south, you can harvest twice in one season. Therefore, seasonality impacts how companies manage their operations in these climatic zones, leading to the concept of an "agricultural year"— a period during which companies assess their production and operational efficiency, distinct from the calendar and fiscal years.

Closer to the equator, seasonality disappears. Farmers there grow crops year-round with crop rotations not attached to seasons. I visited Kenya for a pre-sale event last year, where a company representative explained that they plan their rotations on fields in a staggered manner, gathering two - three crops per year. This is typical especially with vegetables and fresh produce.

Furthermore, the type of crops affects the production cycle. For instance in arable farming, cereals involve planting once and harvesting once. This is a simple cycle where the plant is removed from the field, and the grain is collected in one go. In contrast, vegetables like cucumbers or tomatoes are harvested multiple times, while plant remains in the field. Perennial crops involve the crop establishment phase followed by multiple growing-harvesting cycles. Orchards require tree growing costs to be capitalized.

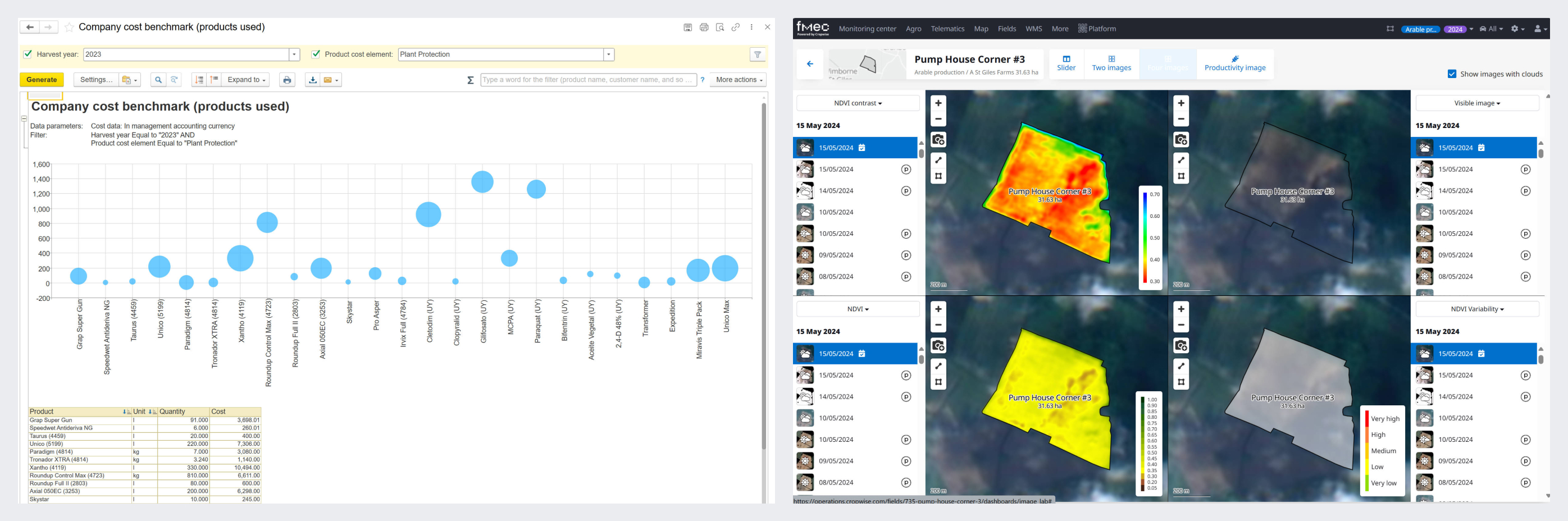

These scenarios require consideration of cost accounting models, such as the agricultural material-to-produce conversion process. Cultivated crop needs to be presented as a component of crop commodity released, much like a semi-finished product in traditional manufacturing. With an ability to present costs both per area of cultivated crop grown and tonnage of crop commodity produced. However, production scenarios in the agricultural sector differ significantly from discrete manufacturing, which includes assembly lines, and machinery manufacturing.

Current State of the Agricultural ERP Market

There are specialized industry solutions available, but these are not based on ERP-tier systems. Major ERP providers like Microsoft, Oracle, and SAP do not offer specific solutions for this industry. Large companies using SAP often develop their bespoke inhouse modules, whereas small and medium-sized businesses tend to rely on local, non-ERP solutions that only provide basic operations management capabilities lacking end-to-end concept implementation.

This is the situation we currently see in markets like the UK, where there are many software solutions for agriculture, but none rise to the level of an integrated ERP system.

In Europe, including England where we primarily operate, agribusinesses are forced to use patchwork automation. That means using 5-6 different systems for various processes—budgeting in one, compliance in another, invoicing in a third, and so on. When we enter the market with our integrated solution, we immediately garner interest because there's no alternative. This advantage is particularly appealing to farmers who have outgrown that patchwork automation and desire a unified, integrated solution to boost their operations.

This need for integration is not limited to small and medium-sized businesses; it's widespread. The largest enterprises in crop farming don’t maintain production records in ERP systems because suitable solutions are lacking. Thus, there's a clear opportunity to be the first to address this gap, although alternatives do exist. Overall, the market's difficulties would be reduced without these ongoing challenges.

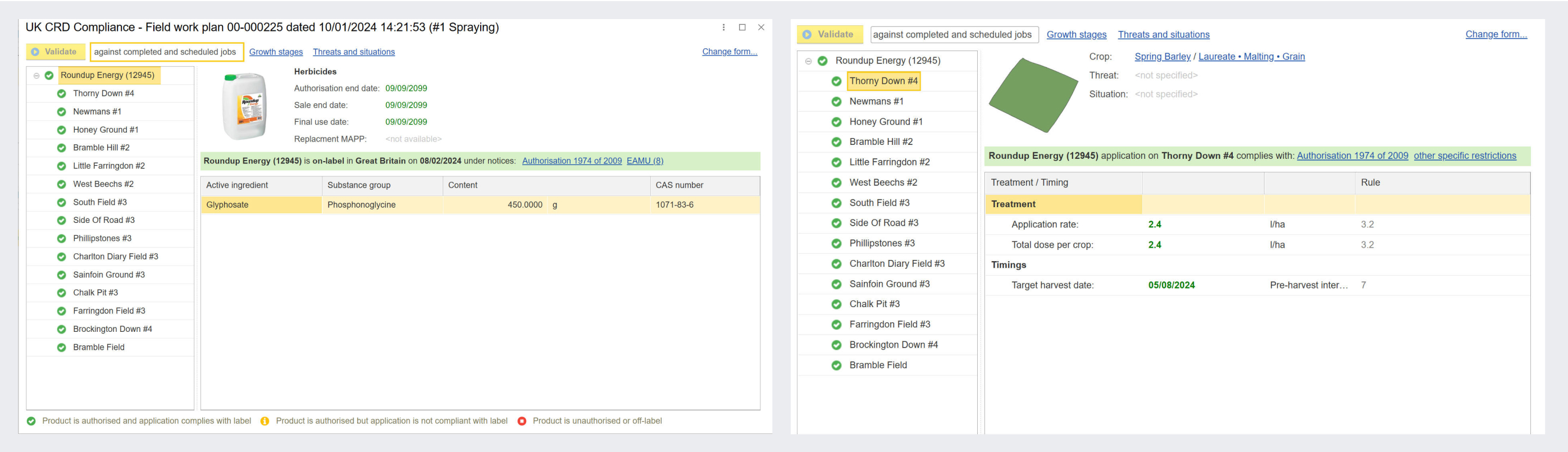

Additionally, agriculture is a sector with strict compliance requirements, and the United Kingdom leads the world in this regard, having the strictest standards imposed on farmers. Farmers cannot simply abandon a local solution in favor of an ERP system unless that ERP includes compliance features covering local legislation. For instance, the ERP must be capable of validating plant protection products applications, keeping records of nutrients supplied with fertilizers used, as compliance in these areas is critical. Therefore, for ERP solutions to be appealing and effective in the agricultural sector, they must ensure they meet these compliance standards.

Stepping back, the demand for an integrated solution is clear. We are developing our system according to certain principles and based on our prior experience, so we're not starting from scratch.

Stay tuned and don’t miss the next part of the article to learn more about Challenges of ERP implementation in Agriculture.