Modern manufacturing companies face the need to manage costs effectively and calculate product costs accurately. Addressing these tasks directly impacts a company's competitiveness, profitability, and market stability. The 1C:ERP software provides powerful tools for managing costs and calculating production costs, making it an indispensable tool for production managers and financial directors.

Allocation of itemized expenses

Expense allocation to inventory costs

Expense allocation to cost of goods sold

Expense allocation to production cost

Expense allocation to financial result by lines of business

Allocation to deferred expenses

Cost of fixed and intangible assets

Allocation of expenses to cost centers

Generation of assets and liabilities

Accounting of other expenses and income

Separate profitability & cost accounting

1C:ERP Enterprise Management allows you to record material, labor, and financial costs. Expense evaluation in monetary terms ensures a comparable record of resource consumption by lines of business.

Key features:

-

Product cost accounting and allocation

-

Registration and allocation of itemized expenses

-

Cost write-off to backflush production

-

Generation of assets and liabilities

-

Calculation of product release cost

-

Accounting of other expenses and income

-

Expense allocation to financial result

In the system, you can register and allocate expenses that generate:

-

Cost of manufactured products. Expenses are included in the cost of manufactured products or performed works.

-

Current asset cost. Full cost of inventory acquisition and ownership.

-

Financial result. Accounting objects are lines of business, companies (including companies used for generating company profits and losses), and responsibility centers as business units.

-

Fixed asset cost. Cost of planned fixed assets and intangible assets, capital construction, and R&D.

Enterprise expenses are divided into the following groups with different allocation procedures:

-

Product costs are used to record direct costs of production activities in quantitative terms.

-

Itemized expenses are used to account for direct and indirect expenses that are recorded and allocated only in monetary terms.

- Generation of assets and liabilities. Recording of transactions related to generation of assets or registration of liabilities that are usually managed manually or registered based on the accounting requirements.

Product cost allocation

All product costs are considered direct production costs in accounting and are recorded in business units in work-in-progress accounts.

Product costs are generated during the following transactions:

-

Transfer of materials to production

-

Return from production

-

Receipt of goods and services

-

Goods transfer between companies

-

Product release and work performance

Product costs are allocated by volume (quantitative) indicators in physical units. Physical units allow tracking receipt lot records for product costs, which is necessary for separate cost accounting and "complex" VAT accounting.

Standard expenses with variances recorded in production documents are included in the cost automatically.

Additional allocation is performed for accounting variances (in the system) and actual (obtained outside the system, for example, during physical inventory count) balances identified at the end of the accounting period.

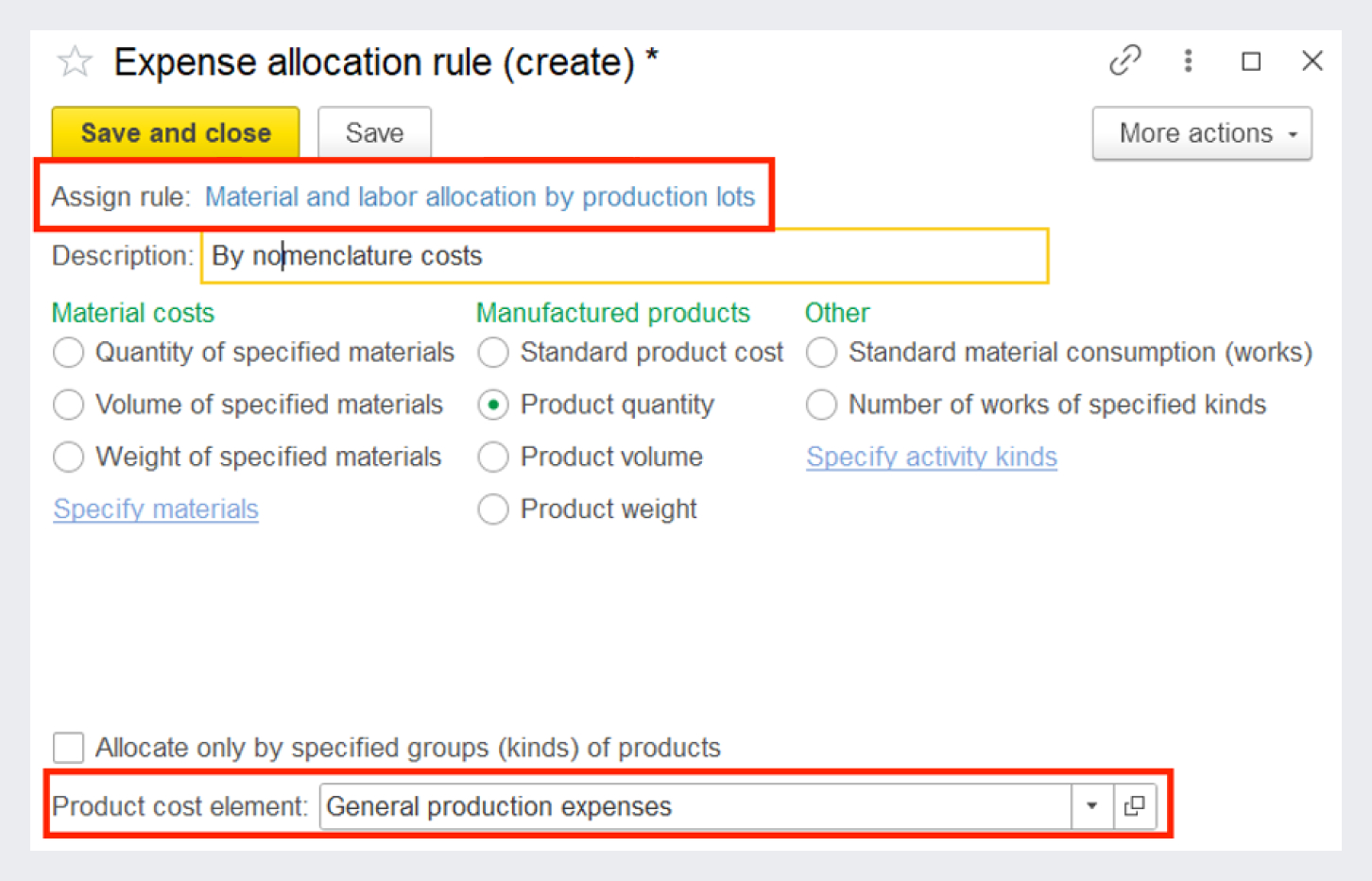

There are several ways to allocate product costs: custom rule, to expense items, by lot, and by release. You can use the options together, just make sure the entire volume of variances is allocated. You can allocate product costs in accordance with the selected expense allocation rule.

To allocate product costs according to the rules, select a cost allocation base: quantity of specified materials, weight of specified materials, standard product cost, and so on.

Creating expense allocation rules

To allocate product costs, use the "Material and labor allocation" document, which allows you to check the allocation base generated according to the selected rule.

Allocation of itemized expenses

Itemized costs are used to account for expenses allocated only in monetary terms. To record itemized costs of an enterprise, use expense items.

The system allocates costs to the financial result as follows:

-

Independent allocation of expenses in management and local accounting by different allocation options.

-

Expense allocation to the financial result by lines of business.

-

Allocation of additional goods expenses in management accounting to the company receiving the expenses, determined by an expense dimension (when using the Intercompany scheme).

There are various options for allocating itemized expenses. They determine the economic sense of expenses recorded under a specific item:

-

To inventory cost

-

To P&L items (expenses of the current period)

-

To deferred expenses

-

To cost of goods sold

-

To production cost (direct)

-

To production cost (overheads)

-

To fixed asset cost

Each itemized expense allocation option has its own allocation procedure.

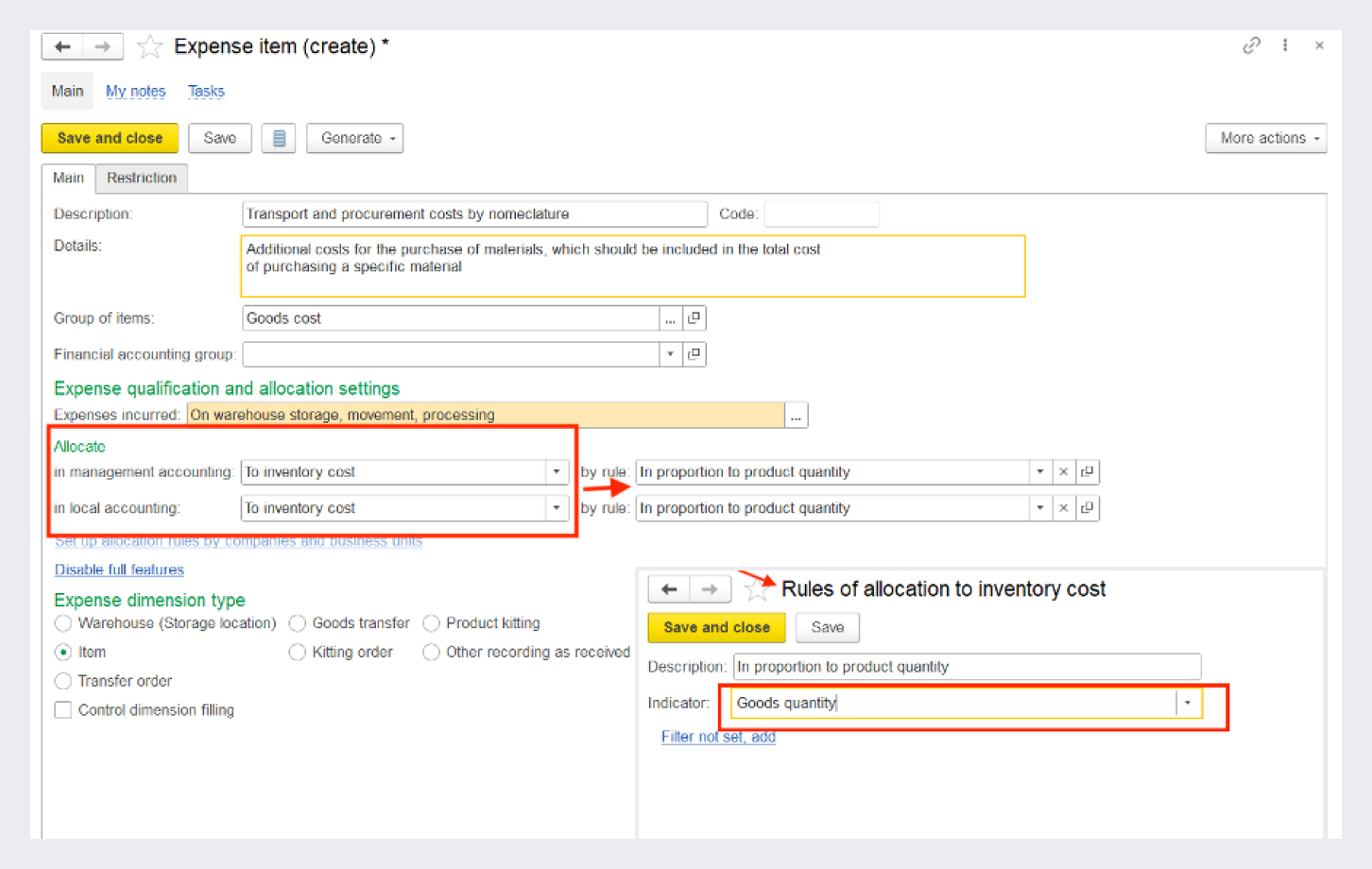

Expense allocation to inventory costs

Expense items with the "To inventory cost" allocation option allow you to increase the cost of inventory by the additional expense amount.

To allocate additional expenses, use rules to allocate them proportionally to one of the following indicators of the selected items:

-

Quantity

-

Cost

-

Weight

-

Volume

Setting up expense item allocation to inventory cost

Amounts of inventory costs outside production processes can be generated broken down by various types of expense dimensions:

-

Warehouse. Cost amount is generated according to the selected rule and allocated to all items located in a specific storage location (warehouse).

-

Item. Cost amount increases the cost of balances of a specific item.

-

Vendor invoice. Amount of costs according to the selected allocation rule increases the cost of items received under the selected Vendor invoice documents.

-

Order (purchase order, sales order, transfer order, kitting order), Goods transfer, Customer invoices — Intercompany, Kitting (reverse kitting). Amount of costs according to the selected allocation rule increases the cost of items specified in the corresponding documents.

Expenses are allocated automatically during month-end closing in the "Expense allocation to inventory costs" documents.

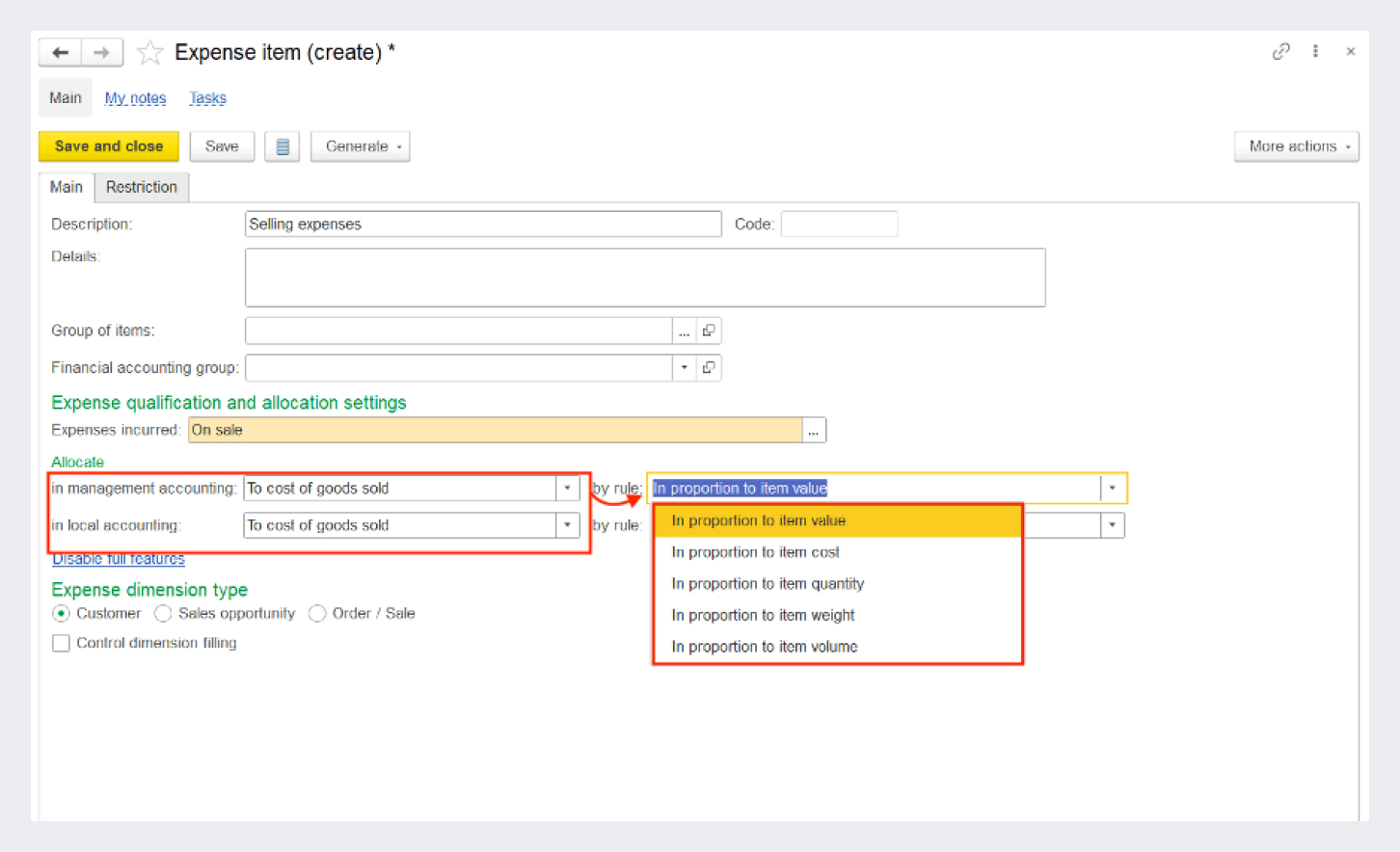

Expense allocation to cost of goods sold

Expense items with the "To cost of goods sold" allocation option map expenses to specific sales.

The allocation base for such expenses is specified in the "Expense items" list card. You can select the following bases for allocating itemized expenses to cost of goods sold:

-

In proportion to item value

-

In proportion to item cost

-

In proportion to item quantity

-

In proportion to item weight

-

In proportion to item volume

Setting up expense allocation to cost of goods sold

Expenses are allocated to cost of goods sold automatically during month-end closing.

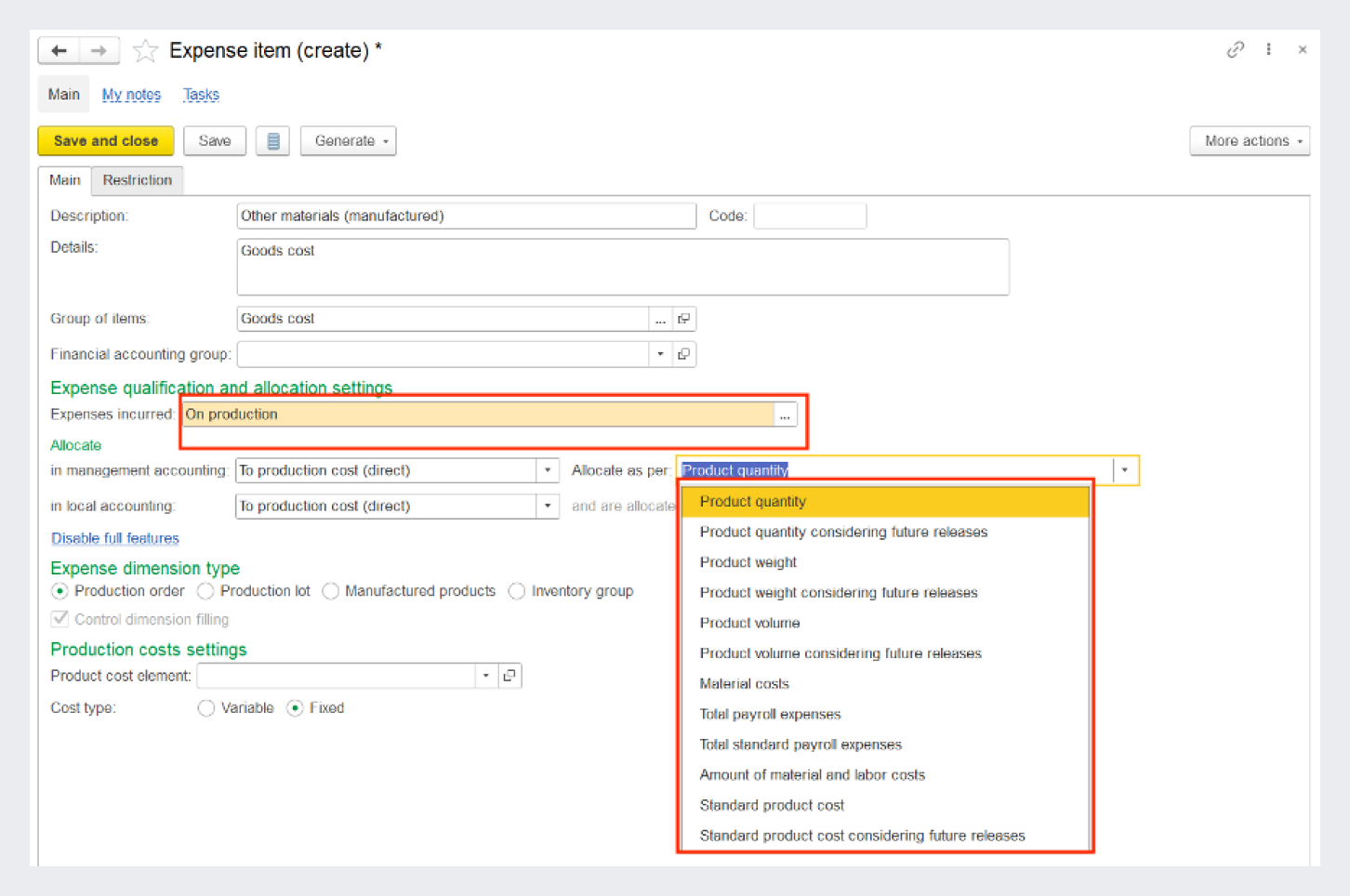

Expense allocation to production cost

There are two options for allocating expenses to the production cost: "To cost of production (direct)" and "To production cost (overheads)".

Expense items with the "To production cost (direct)" allocation option are used to record itemized expenses that are directly allocated to the production cost. Possible types of itemized expense dimensions for this distribution option are Production lot, Production order, and Product group. Expenses with the "Production lot" dimension are allocated to a specific lot. Expenses with the "Production order" and "Inventory group" dimensions are allocated by allocation base.

Setting up expense allocation to production cost (direct)

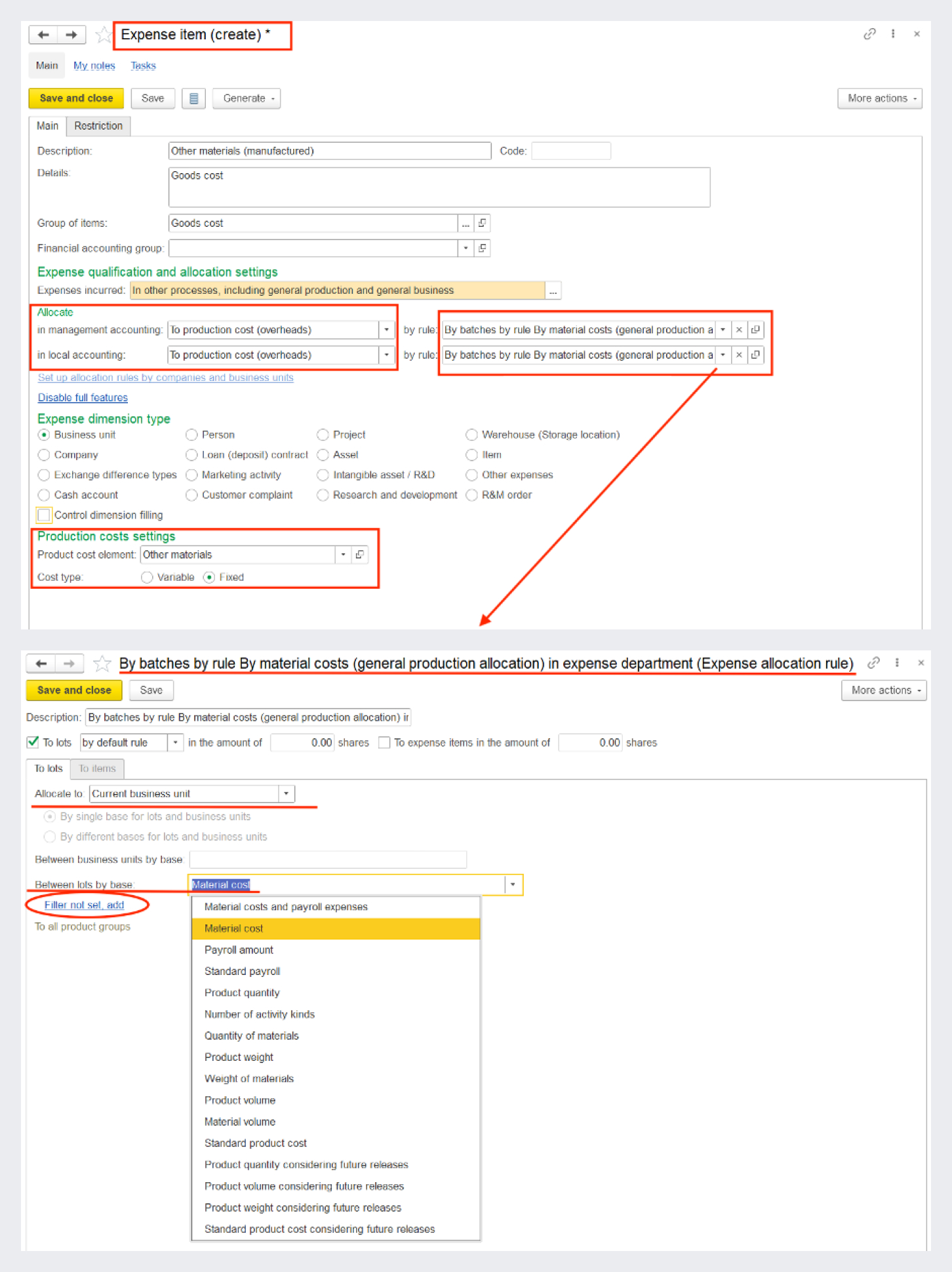

Expense items with the "To production cost (overheads)" allocation option are used to generate production costs allocated to the cost of manufactured products.

Itemized expenses can be allocated to production lots left in work-in-progress or reallocated to other items.

Costs are allocated according to a rule set up in advance and specified during allocation. You can create a complex allocation rule by simultaneously specifying allocation by lots and expense items and cost shares for each option.

The allocation rule determines business units to which expenses are allocated and the allocation base for business units and lots. In the allocation rule, you can set various filters for business units to which expenses must be allocated, and filters for expense allocation bases.

Setting up an expense item with the To production cost (overheads) allocation option and a distribution rule

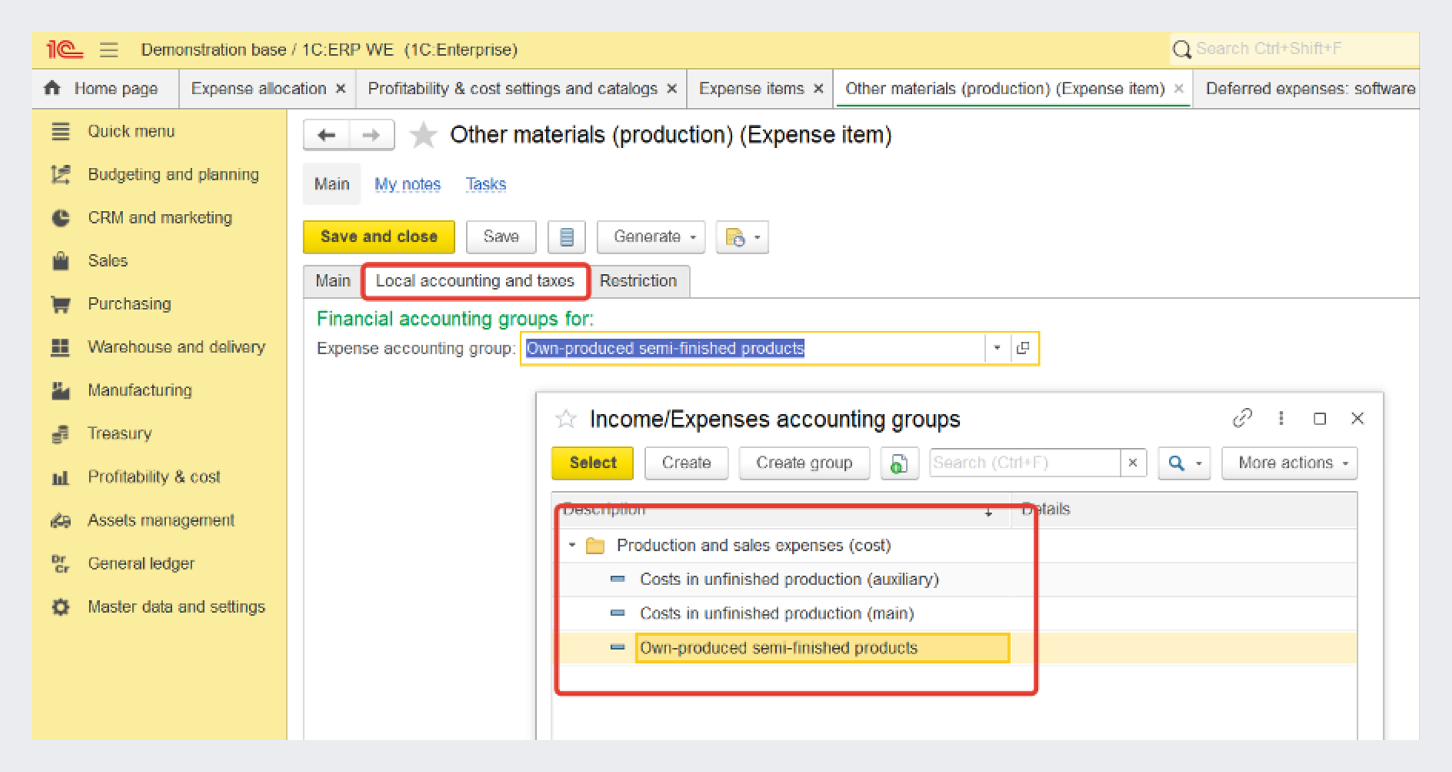

Itemized costs are included in the cost of manufactured products in accordance with the specified product cost element. Product cost elements are used to generate the cost of manufactured products and determine the type of costs included in the product cost.

To calculate income tax, production costs are classified as direct or indirect.

Setting up classification of expense items for calculating income tax

To allocate expenses to the production cost, use the "Expense allocation" document. In this document, you can allocate production costs assigned to a line of business to production lots with other lines of business.

Expense allocation to financial result by lines of business

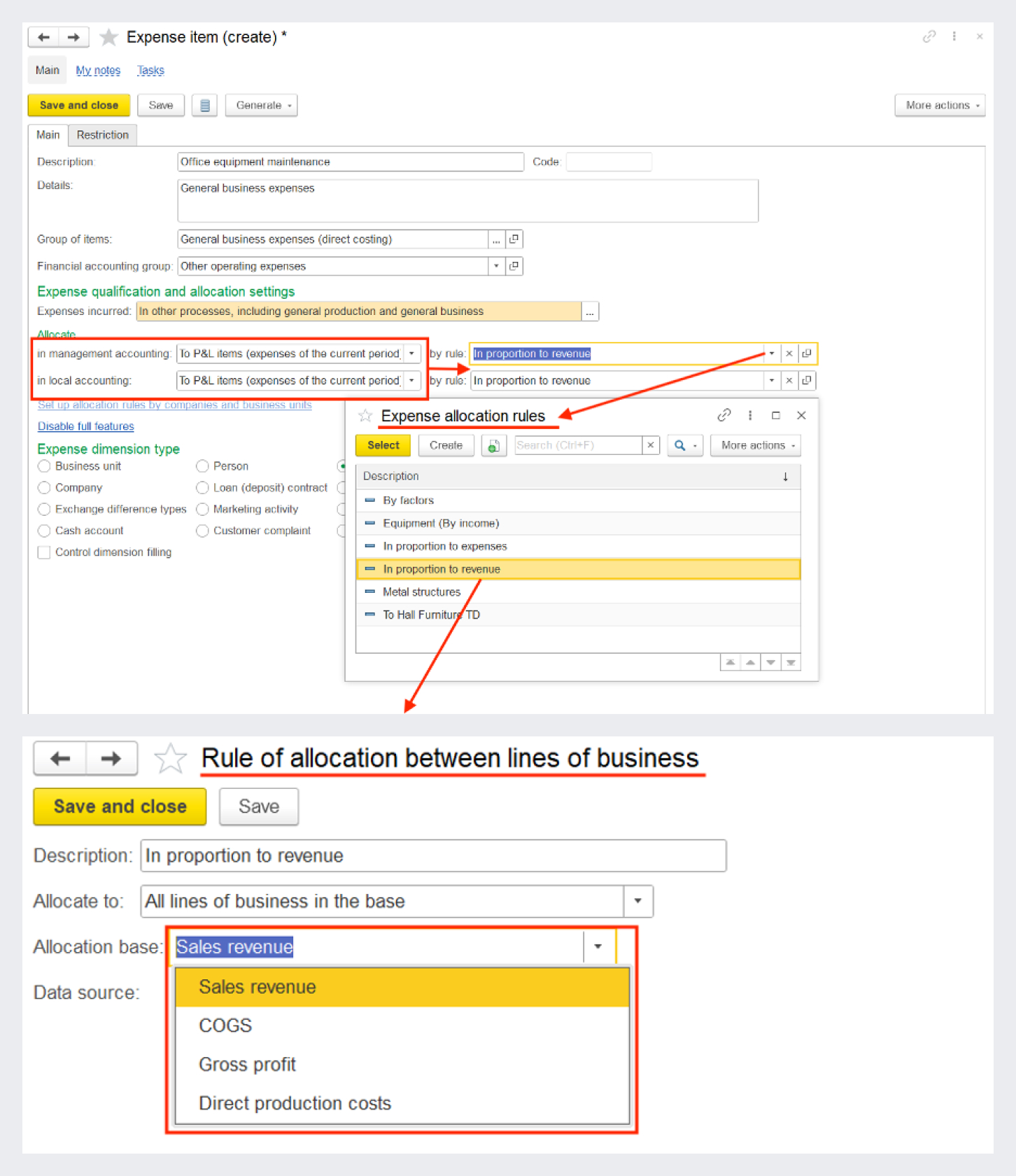

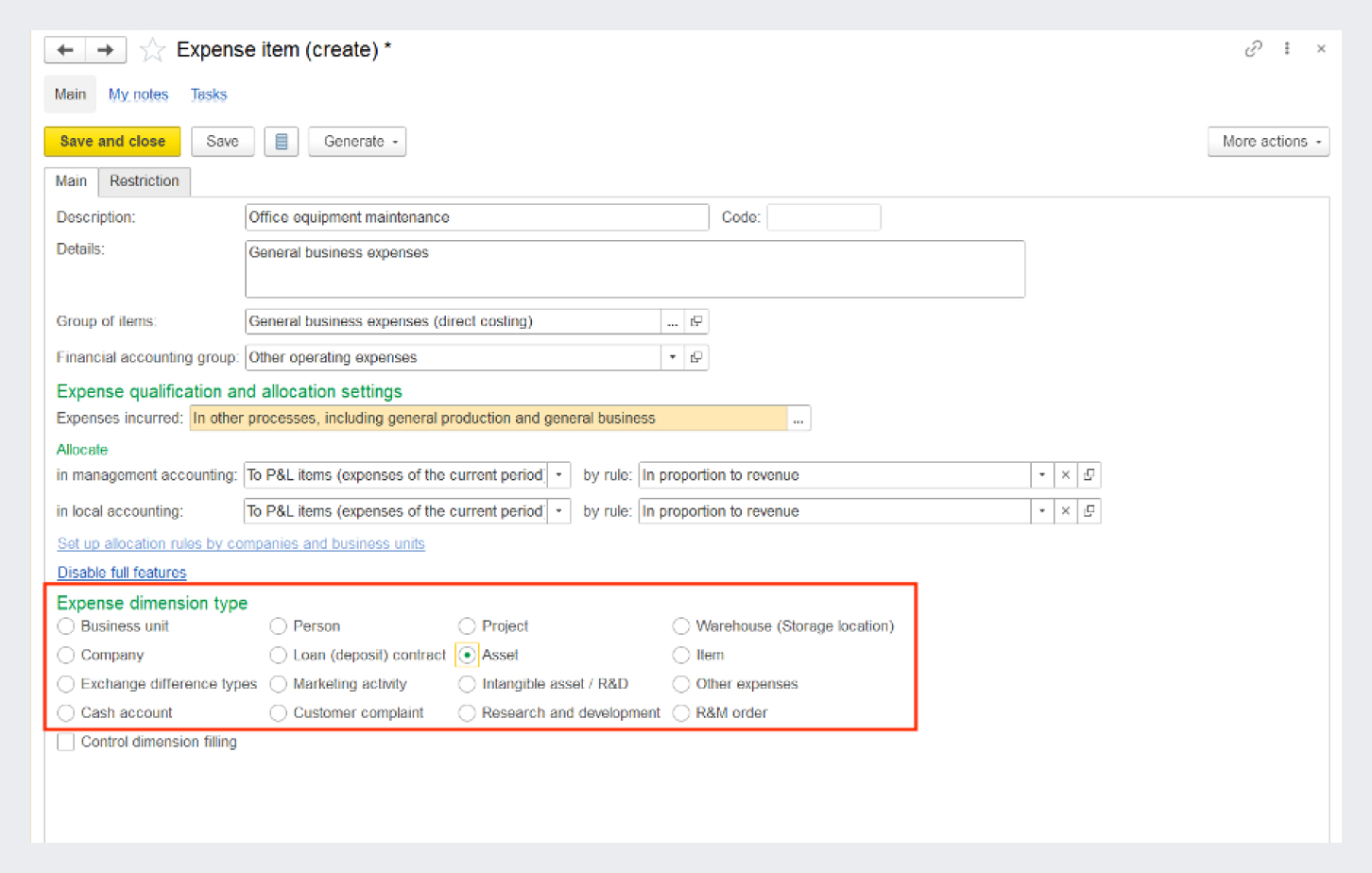

Expense items with the "To financial result" allocation option record general business costs whose financial and economic nature is determined by the rule for allocating expenses by lines of business.

Setting up an expense item with an allocation rule by lines of business

You can allocate expenses by lines of business by the following bases:

-

Sales revenue

-

COGS

-

Gross profit

-

Direct production costs

Cost amounts by lines of business can be generated broken down by various types of expense dimensions, for example:

-

Business unit. Costs related to the activities of the selected unit.

-

Line of business. Direct influence on the financial result of the enterprise by the selected line of business.

-

Customer complaint. Assessment of the cost for eliminating the received complaints.

-

Sales order. Generation of the full cost of order fulfillment. You can get a local financial result for the order.

-

Asset. Control of expenses ensuring the use, maintenance, and repair of assets (equipment, buildings, and so on).

Setting up the expense dimension kind

You can simultaneously select a dimension kind and an allocation rule to analyze costs by two dimensions.

For example, specify the "Customer complaint" dimension kind and the set the "To line of business" allocation rule to "Warranty repair". This will generate the total cost of expenses for warranty repairs broken down by cost of eliminating all received complaints.

To allocate expenses by lines of business, use the "Expense allocation" document.

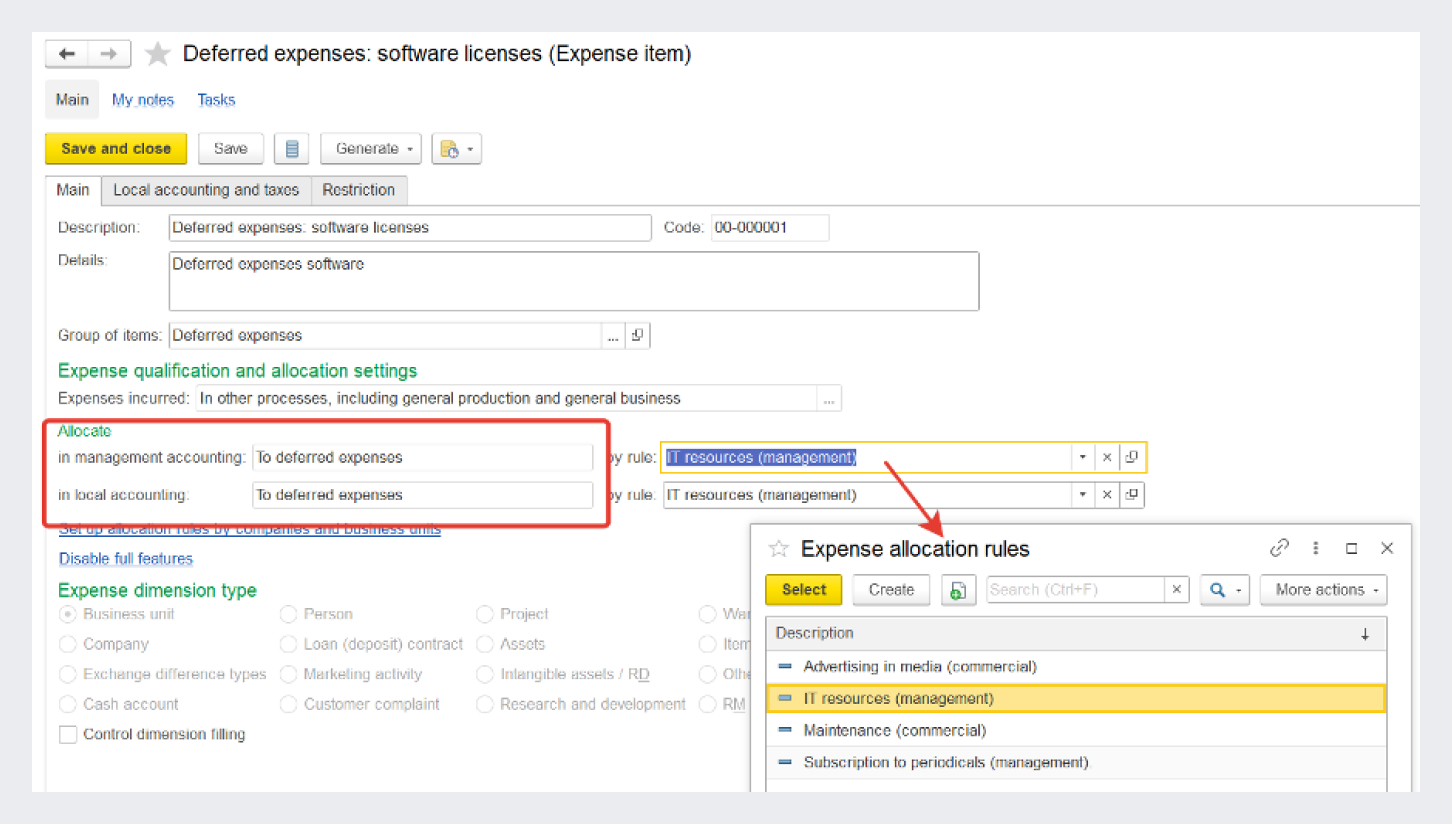

Allocation to deferred expenses

Expense items with the "To deferred expenses" allocation option record expenses that will be included in the cost later.

Expense items classified as deferred expenses have dimension kinds, but they only indicate where the costs arise. Expenses by items allocated to deferred expenses are allocated according to the configured rules.

Setting up an expense item with the To deferred expenses allocation rule

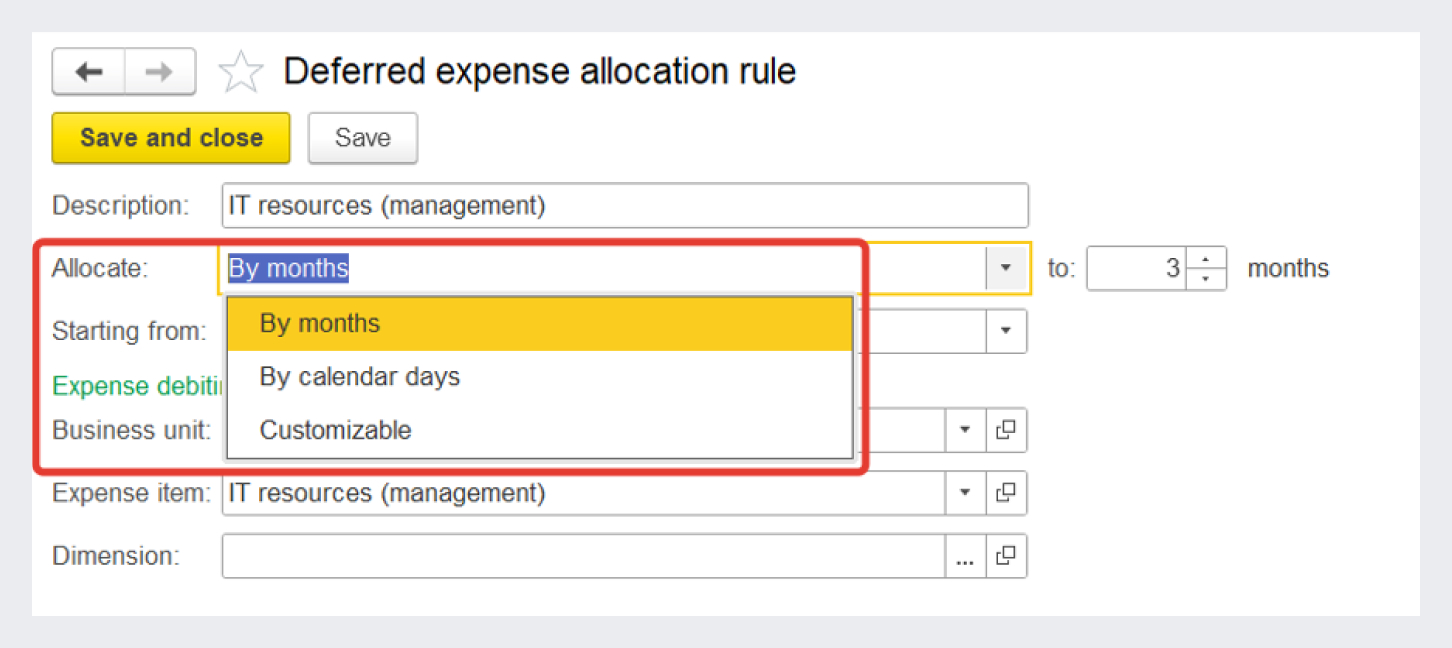

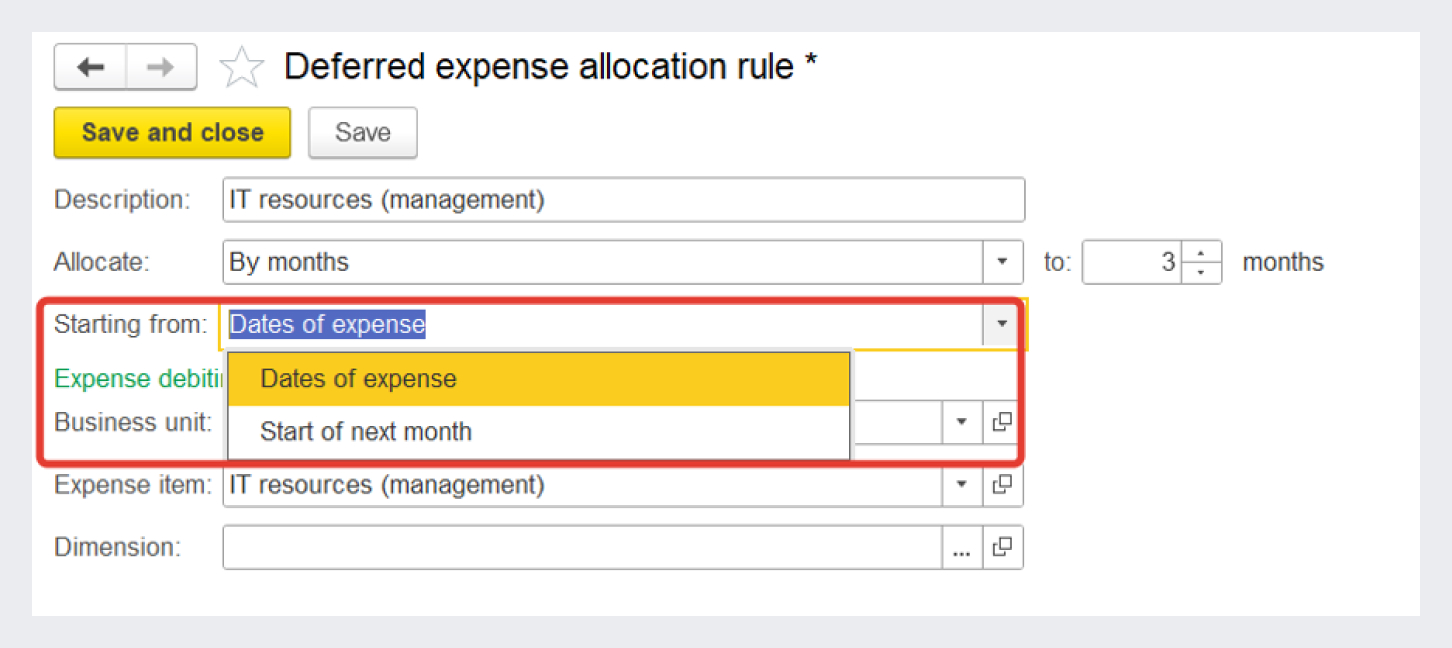

Deferred expense allocation rule identifies:

-

Expense allocation procedure (By month, By calendar days, or Customizable).

-

Date from which the costs will be allocated. You can start allocating deferred expenses from the expensing dates or from the start of the next month following the expensing date.

-

Number of months to which the expenses will be allocated.

-

Parameters of expense write-off dimension indicating a business unit and expense item with the corresponding dimension value.

Deferred expense allocation rule

To allocate costs to deferred expenses, use the "Deferred expense allocation" document. The cost amount is allocated to the specified number of periods.

The "Deferred expense allocation" document is generated according to the rule selected for the expense item to allocate. You can specify allocation parameters of a specific expense directly in the "Deferred expense allocation" document.

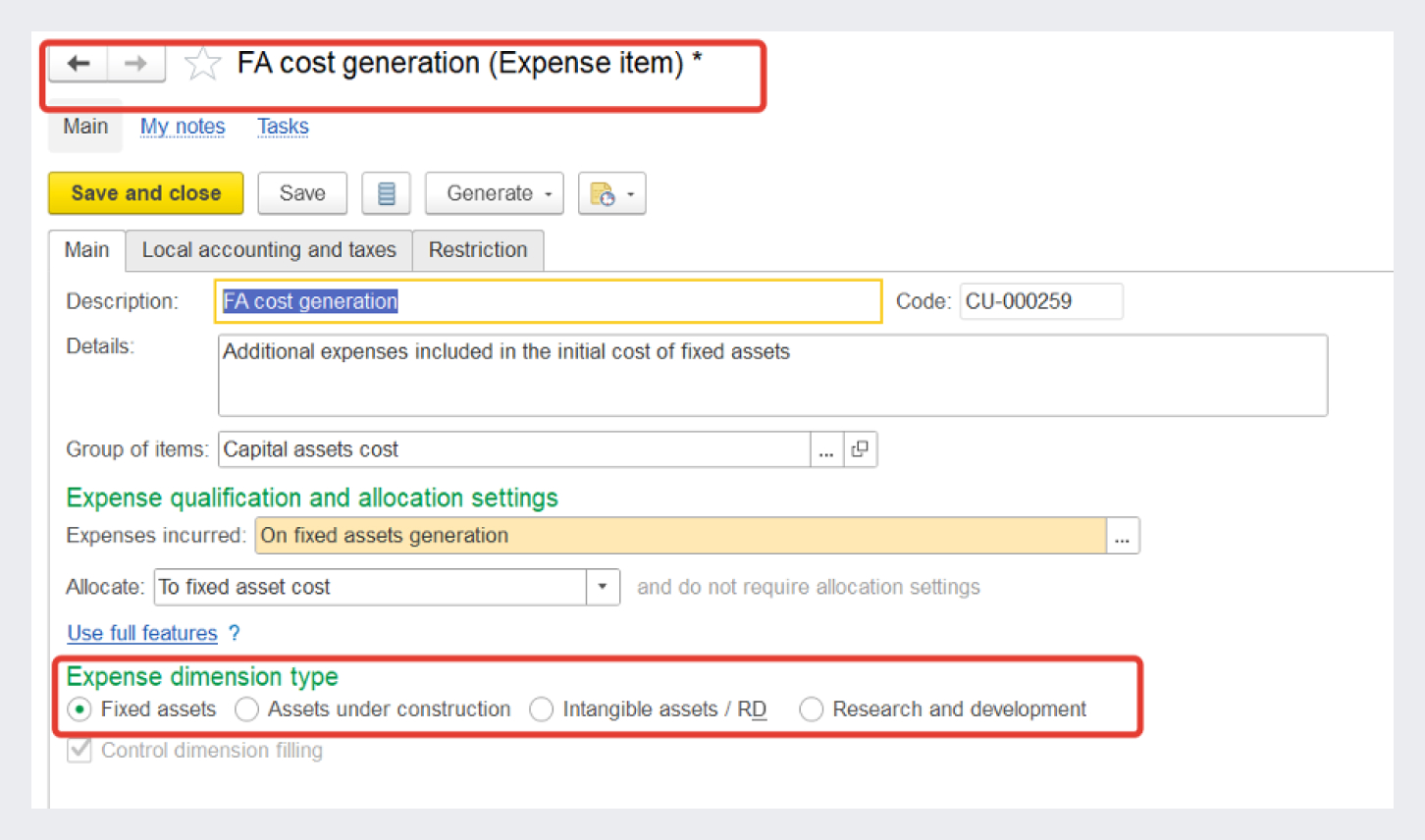

Cost of fixed and intangible assets

Allocation to fixed and intangible assets allows you to record expenses related to cost of fixed and intangible assets.

Cost amounts by fixed and intangible assets can be broken down by various types of expense dimensions:

Kinds of expense dimensions

Allocation of expenses to cost centers

Cost center in itemized expense accounting is an auxiliary accounting entity intended for the accumulation, transit, and distribution of heterogeneous expenses with similar accounting principles.

A cost center is a dimension of an expense item. It can be used:

-

As an aggregation node for detailed itemized cost accounting in source documents, but for aggregate allocation in the future.

-

As an intermediate "transport" node to accumulate costs for their further itemized allocation based on the same principles.

-

For detailed cost accounting by both system objects (for example, work centers and teams) and non-system objects for which there are no corresponding dimensions in the structure of accounting dimensions of itemized expenses.

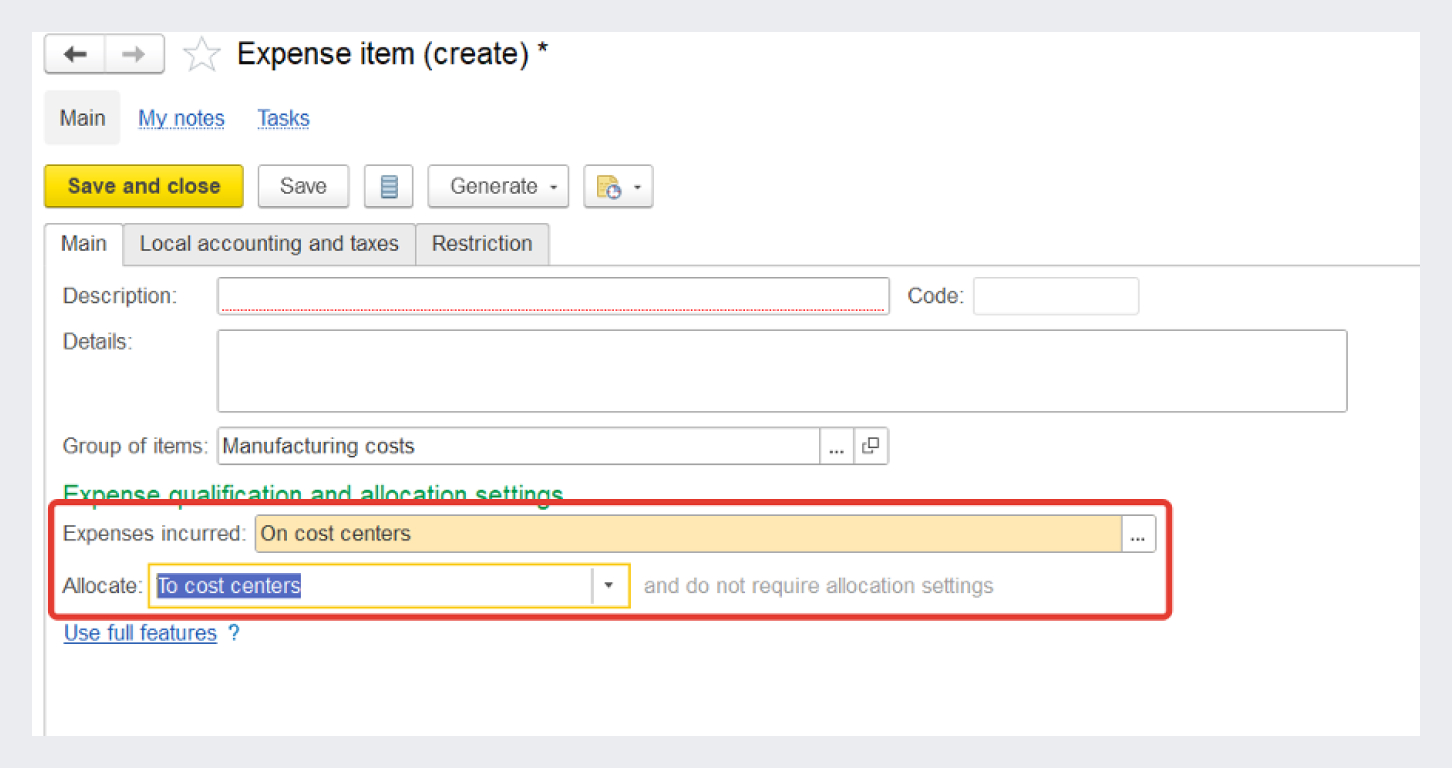

To organize accounting of itemized expenses using cost centers, the "Expense items" list card contains the "On cost centers" expense qualification option and the "To cost centers" allocation option.

Setting up expense item allocation to cost centers

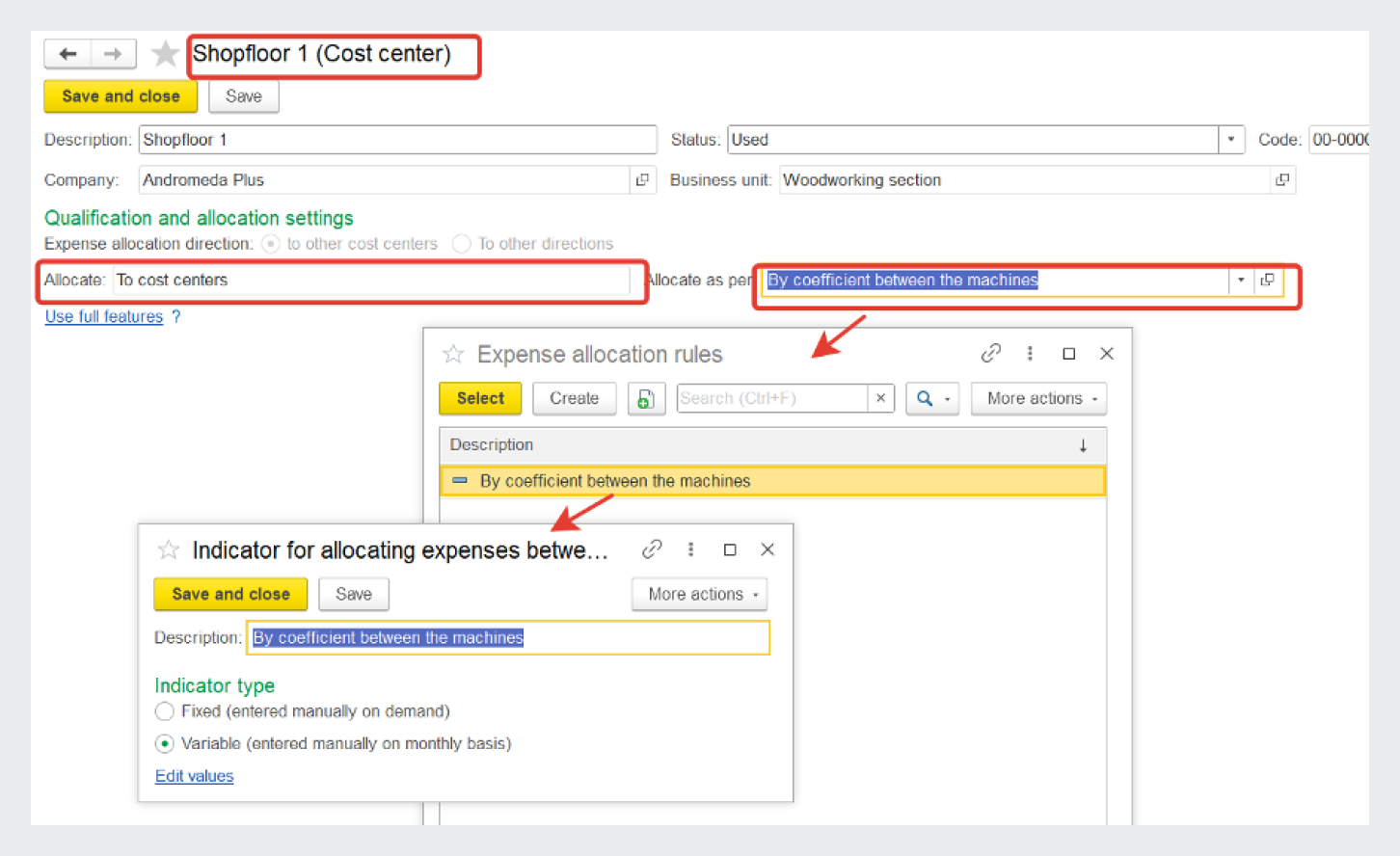

Cost centers are kept in the "Cost centers" catalog. You can set up the expense allocation procedure in the "Cost centers" list item card.

Setting up expense allocation indicators for cost centers in the cost centers card

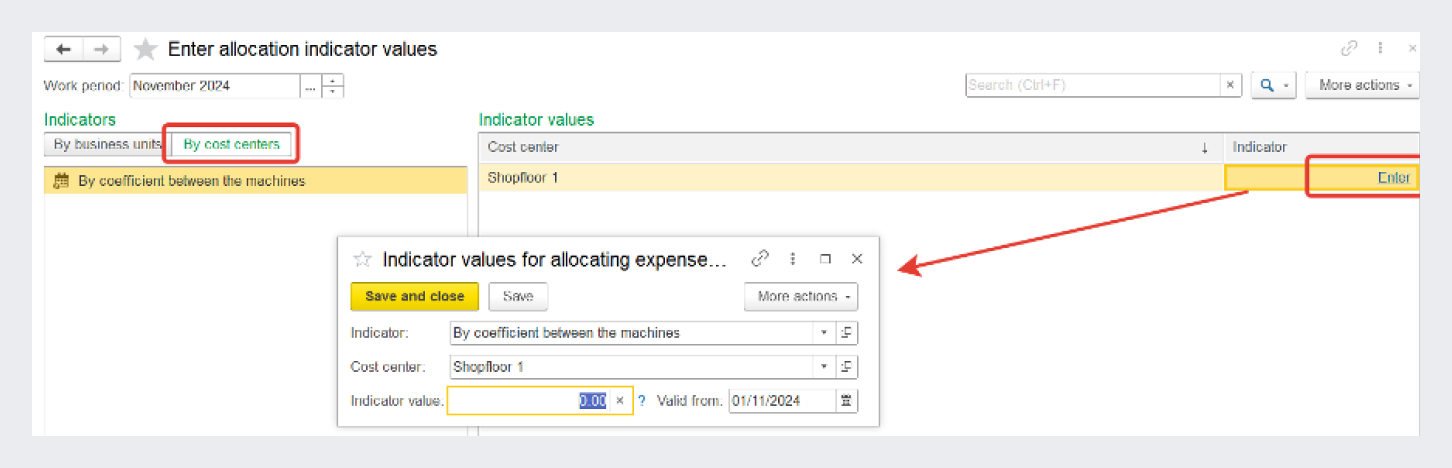

You can enter the values of expense allocation indicators by cost centers in the "Allocation rules and indicators" list item card (click "Edit values") and in the "Enter allocation indicator values"workplace.

Entering allocation indicators by cost centers

Allocation is performed automatically upon month-end closing.

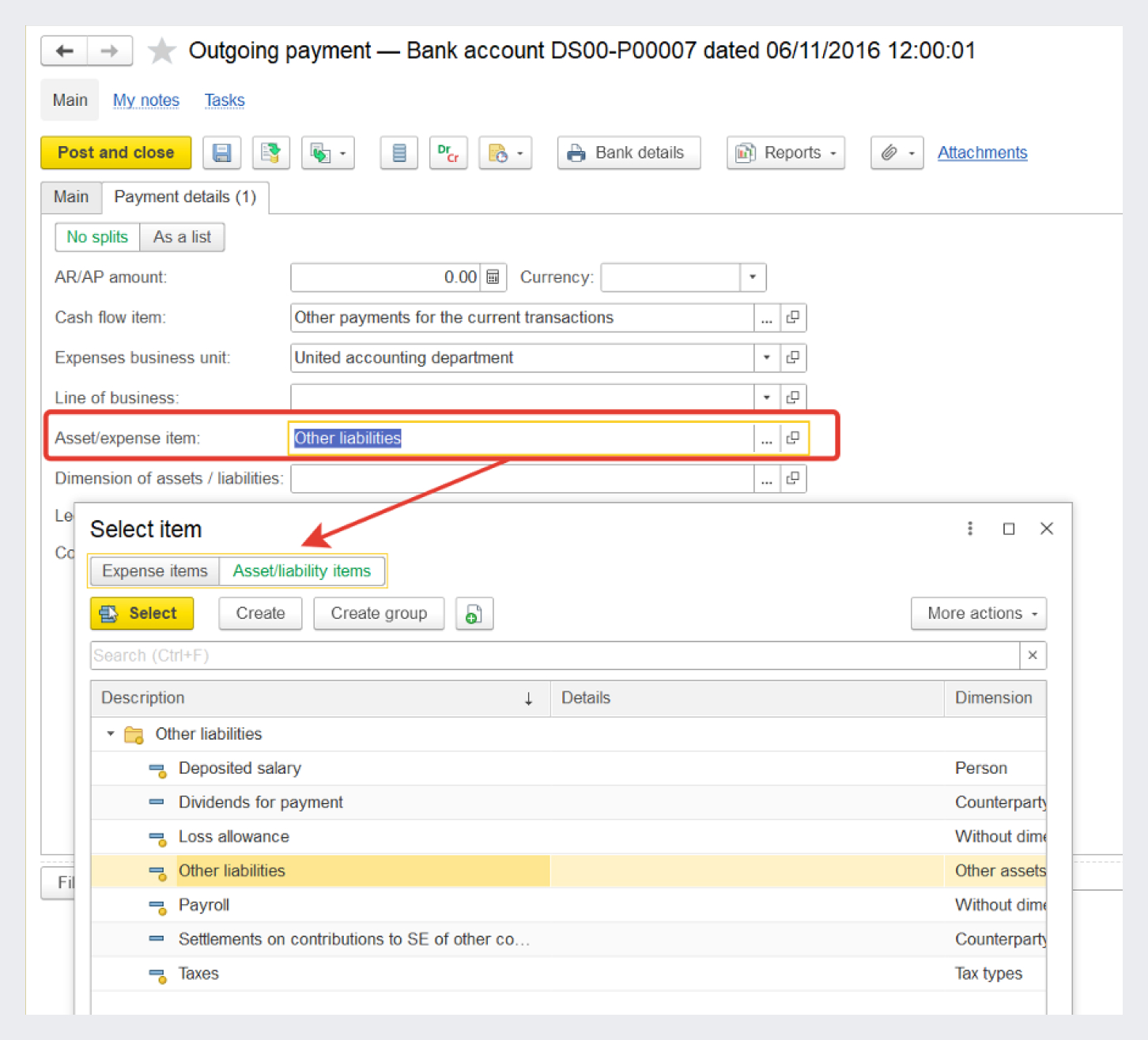

Generation of assets and liabilities

To record other transactions in the balance sheet, you can generate assets and liabilities. Assets and liabilities are generated during the following transactions:

-

Tax payment

-

Other expenses

-

Other income

To register other transactions, use standard documents where the asset/liability items are specified.

Example of liability generation

Product release cost

Cost calculation is essential for generating the financial result of the enterprise.

You can record the resource assignment only after the production stages where they were irreversibly processed are completed. Based on the data of already completed business transactions, you can identify what the resources were used for and specify the cost item.

Production cost is the most important indicator of the production and economic activity of an enterprise. Cost calculation is required for the following purposes:

-

Calculate the profitability of production and individual product kinds

-

Identify reserves for reducing production costs

-

Generate the pricing policy of the enterprise

-

Calculate the economic efficiency of the implemented innovations

-

Make informed decisions about adjusting the composition of manufactured products

-

Preliminary calculation is intended for trading companies to determine the estimated cost of purchased inventory during the accounting period. It is performed using the weighted average assessment method. The calculated values are used to determine the company's gross profit, provided that the sales forecast is met. To calculate the preliminary cost, you can set up a scheduled job.

- Actual calculation is performed based on the results of the monthly accounting period with a full calculation of cost by product cost record lots.

-

Weighted average. Cost of writing off goods is calculated by the average price in the accounting period.

-

FIFO. Cost of writing off goods by FIFO is calculated within full-featured lot accounting.

To calculate actual costs, use a universal workplace called "Month-end closing", where you can record closing transactions for all accounting periods.

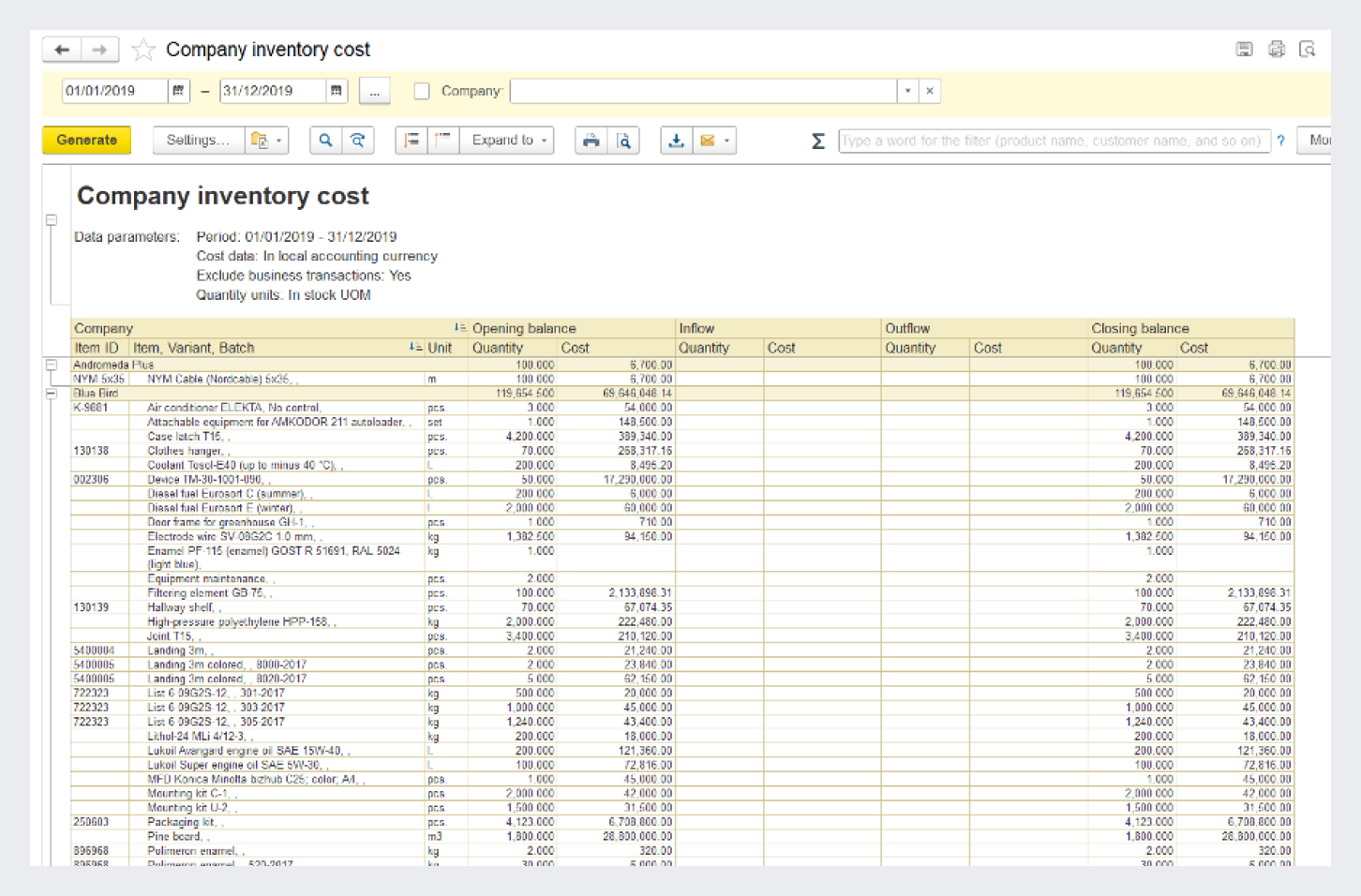

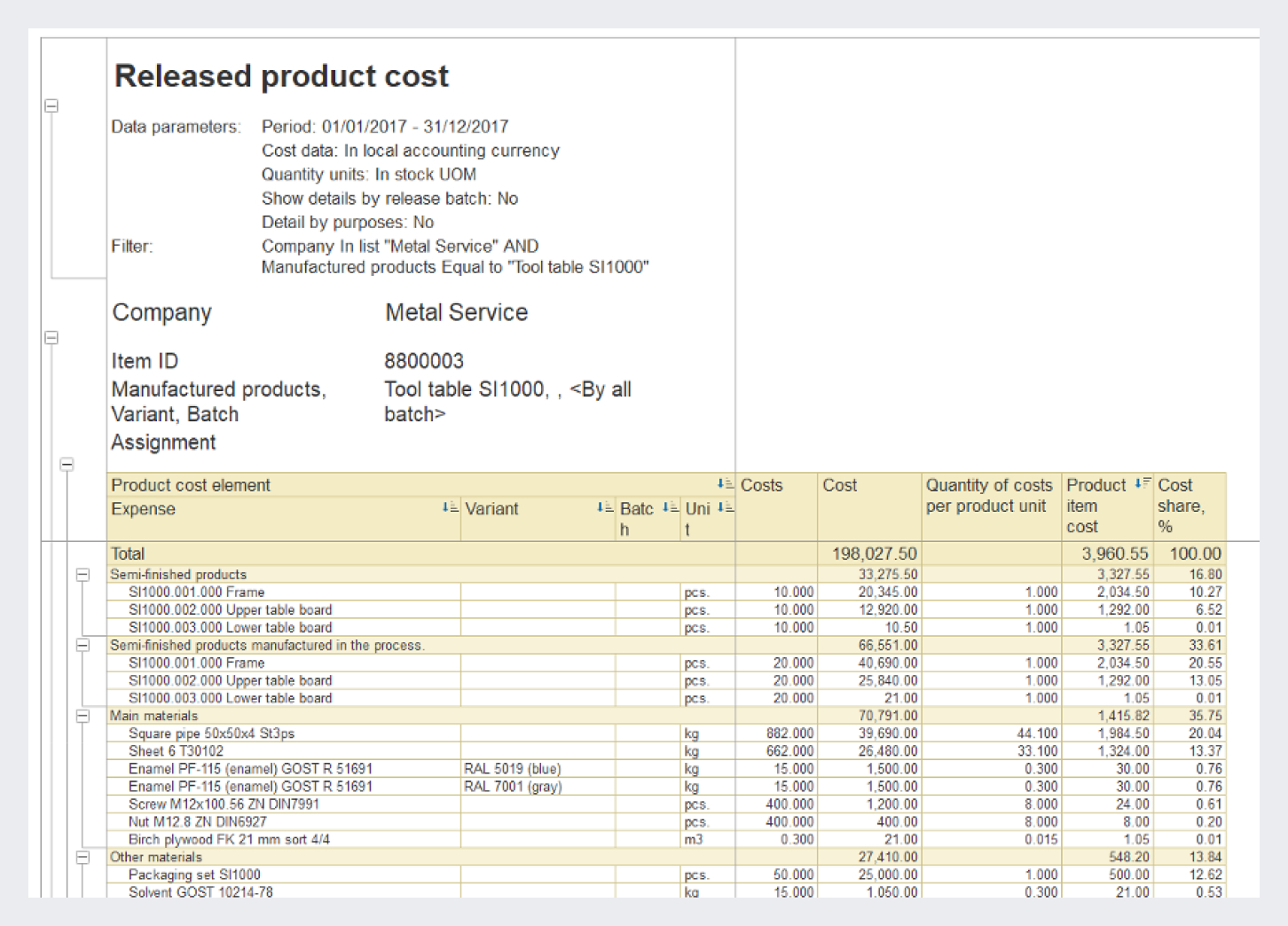

Use dedicated reports to analyze production costs, for example, "Company inventory cost" and "Released product cost".

Released product cost report

Accounting of other expenses and income

You can record other expenses of companies, additional expenses on goods, and deferred expenses related to the financial results of the enterprise.

Costs incurred in the course of business arise when you record the following transactions:

-

Receipt of goods and services

-

Receipt of services and assets

-

Purchase of inventory, monetary documents, other intangible assets and non-current assets

-

Outgoing payment — Bank account

-

Cash issue etc.

You can also record other income and expenses not related to the sale of goods and services related to core activities (dividends, interest on deposits, and so on).

Use the following transactions to keep records of other expenses and income in 1C:ERP:

-

Expense (income) registration. Allows you to record arbitrary expenses (income) for a selected expense (income) item.

-

Expense (income) reclassification. Allows you to transfer previously generated expenses (income) from one expense (income) item to another expense (income) item.

-

Expense write-off. Writes off expenses previously generated in a specific business unit under the expense item specified in the document.

-

Income reversal.

-

Expense reversal.

When you record any type of transaction, the amounts of management, local, and tax accounting are not required to fill in, which allows you to record transactions in one accounting type only.

Separate profitability & cost accounting

In 1C:ERP, you can generate financial results from sales of goods and works separately by orders, sales opportunities, business units, managers, vendors, and groups of financial accounting of goods.

For each assignment object, you can generate a complete financial result (cost, revenue, profit, and profitability). You can see the financial result by assignment objects in various options of the "Gross profit" and "Income and expenses" reports.

Balance sheet statement

To assess the financial condition of an enterprise, use the "Balance sheet statement" report. It is a simplified version of the balance sheet.

The "Balance sheet statement" report allows you to manage assets and liabilities and control the use of financial resources. It includes data on financial accounting of goods, AR/AP with customers and vendors, balances of cash and non-cash funds, and other assets and liabilities.

The report can be generated both for the whole enterprise and for each individual company. Each section of the Balance sheet statement can be broken down by document with individual business transactions. Information about balance violations is displayed separately, which allows you to identify possible accounting errors.

Use the "Income and expenses" report for comprehensive analysis of all income and expenses of the enterprise by item.